| Filed by the Registrant | Filed by a Party other than the Registrant |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | Filed by a Party other than the Registrant |

| | Check the appropriate box: | | ||||||

| Preliminary Proxy Statement | ||||||||

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | ||||||||

| Definitive Proxy Statement | ||||||||

| Definitive Additional Materials | ||||||||

| Soliciting Material under §.240.14a-12 | ||||||||

Tremont Mortgage Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | Payment of Filing Fee (Check the appropriate box): | | ||||||

| No fee required. | ||||||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||||||

| | | | | | | | | |

| (1) Title of each class of securities to which transaction applies: | ||||||||

| | | | | | | | | |

| (2) Aggregate number of securities to which transaction applies: | ||||||||

| | | | | | | | | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined) : | ||||||||

| | | | | | | | | |

| (4) Proposed maximum aggregate value of transaction: | ||||||||

| | | | | | | | | |

| (5) Total fee paid: | ||||||||

| Fee paid previously with preliminary materials. | ||||||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||||||

| | | | | | | | | |

| (1) Amount Previously Paid: | ||||||||

| | | | | | | | | |

| (2) Form, Schedule or Registration Statement No.: | ||||||||

| | | | | | | | | |

| (3) Filing Party: | ||||||||

| | | | | | | | | |

| (4) Date Filed: | ||||||||

Tremont Mortgage Trust

Notice of 20182019 Annual Meeting

of Shareholders and Proxy Statement

Wednesday, April 25, 201824, 2019 at 1:30 p.m., Eastern time

Two Newton Place, 255 Washington Street, Suite 100, Newton, Massachusetts 02458

Tremont Mortgage Trust

It is our pleasure to invite you to join our Board of Trustees and executive officers at Tremont Mortgage Trust's 20182019 Annual Meeting of Shareholders in Newton, Massachusetts. The enclosed Notice of 20182019 Annual Meeting of Shareholders and Proxy Statement provides you with information about our Company and the matters to be voted on at the 20182019 Annual Meeting of Shareholders.

We are committed to effectively communicating with our shareholders and explaining the matters to be addressed at our 20182019 Annual Meeting of Shareholders. This Proxy Statement includes a Question and Answer section with information that we believe may be useful to our shareholders.

Your support is important to us and to our Company. I encourage you to use telephone or internet methods or sign and return a proxy card/voting instruction form to authorize your proxy prior to the meeting so that your shares will be represented and voted at the meeting.

Thank you for being a shareholder and for your continued investment in our Company.

February 23, 2018March 8, 2019

On behalf of the Board of Trustees,

Jeffrey P. Somers

Chair of the Nominating and Governance Committee

NOTICE OF 20182019 ANNUAL MEETING OF SHAREHOLDERS

Wednesday, April 25, 201824, 2019

1:30 p.m., Eastern time

Two Newton Place, 255 Washington Street, Suite 100

Newton, Massachusetts 02458

ITEMS OF BUSINESS

RECORD DATE

The Board of Trustees set February 1, 2018January 31, 2019 as the record date for the meeting. This means that owners of record of the common shares of the Company as of the close of business on that date are entitled:

PROXY VOTING

Shareholders as of the close of business on the record date are invited to attend the 20182019 Annual Meeting. All shareholders are encouraged to vote in advance of the 20182019 Annual Meeting by using one of the methods described in the accompanying Proxy Statement.

February 23, 2018March 8, 2019

Newton, Massachusetts

By Order of the Board of Trustees,

Jennifer B. Clark

Secretary

Please promptly sign and return the proxy card or voting instruction form or use telephone or internet methods to authorize a proxy in advance of the 20182019 Annual Meeting. See the "Voting Information" section on page 2 for information about how to authorize a proxy by telephone or internet or how to attend the 20182019 Annual Meeting and vote your shares in person.

TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 1

VOTING INFORMATION

WE WANT TO HEAR FROM YOU – VOTE TODAY

Your vote is important.

ELIGIBILITY TO VOTE

You can vote if you were a shareholder of record at the close of business on February 1, 2018.January 31, 2019.

PROPOSALS THAT REQUIRE YOUR VOTE

| PROPOSAL | MORE INFORMATION | BOARD RECOMMENDATION | VOTES REQUIRED FOR APPROVAL | |||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| 1 | Election of Trustees | Page | FOR | Plurality of all votes cast | ||||

| 2 | Ratification of independent auditors* | Page | FOR | Majority of all votes cast | ||||

| | | | | | | | | |

You can vote in advance in one of three ways:

via the internet  | Visit www.proxyvote.com and enter your 16 digit control number provided in your Notice Regarding the Availability of Proxy Materials, proxy card or voting instruction form before 11:59 p.m., Eastern time, on April | |

Call 1-800-690-6903 if you are a shareholder of record and 1-800-454-8683 if you are a beneficial owner before 11:59 p.m., Eastern time, on April | ||

| Sign, date and return your proxy card if you are a shareholder of record or voting instruction form if you are a beneficial owner to authorize a proxyBY |

If the meeting is postponed or adjourned, these times will be extended to 11:59 p.m., Eastern time, on the day before the reconvened meeting.

PLEASE VISIT: www.proxyvote.com

Important Note About Meeting Admission Requirements: If you plan to attend the meeting in person, see the answer toquestion 1411 beginning on page 109 of "Questions and Answers" for important details on admission requirements.

2 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement

PROXY SUMMARY

This summary highlights matters for consideration by shareholders at our 20182019 Annual Meeting. You should read this entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

BOARD NOMINEES (page 16)13)

The following two Trustees are up for election to our Company's Board of Trustees.

| Name of Trustee | Age | Occupation | Committee Memberships | |||

|---|---|---|---|---|---|---|

| | | | | | | |

| None | |||||

| Audit, Compensation (Chair) and Nominating and Governance | |||||

| | | | | | | |

RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS (page 44)42)

Shareholders are asked to ratify the appointment of Ernst & Young LLP as independent auditors of Tremont Mortgage Trust for the Company's fiscal year ending December 31, 2018.2019. The Company's Audit Committee evaluates the performance of the Company's independent auditors and determines whether to reengage the current independent auditors or consider other audit firms. In doing so, the Audit Committee considers the quality and efficiency of the services provided by the auditors, the auditors' technical expertise and knowledge of the Company's operations and industry, the auditors' independence, legal proceedings involving the auditors, the results of PCAOB inspections and peer quality reviews of the auditors and the auditors' reputation in the marketplace. Based on its consideration of these matters, the Audit Committee has appointed Ernst & Young LLP to serve as independent auditors for the fiscal year ending December 31, 2018.2019.

TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 3

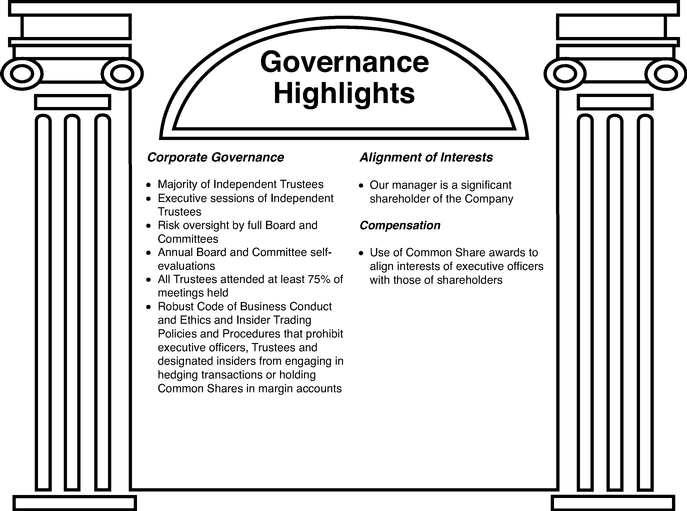

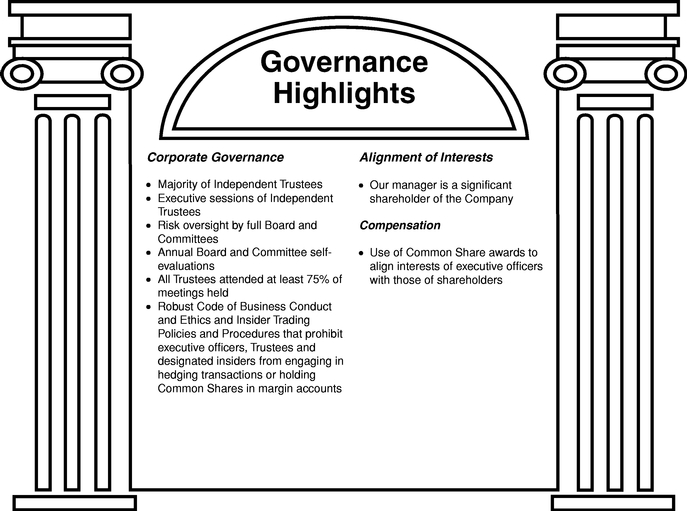

GOVERNANCE HIGHLIGHTS (page 25)22)

The Company is committed to good corporate governance, which promotes the long term interests of its shareholders, strengthens the Board, increases management's accountability and helps build public trust in the Company. This commitment is reflected in various aspects of the Company's corporate governance, including:

4 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement

TWO NEWTON PLACE

255 WASHINGTON STREET, SUITE 300

NEWTON, MASSACHUSETTS 02458

February 23, 2018March 8, 2019

PROXY STATEMENT

The Board of Trustees (the "Board") is furnishing this Proxy Statement to solicit proxies to be voted at the 2018 Annual Meeting of Shareholders (the "2018 Annual Meeting") of Tremont Mortgage Trust a Maryland real estate investment trust (together with its direct or indirect subsidiaries, the(the "Company," "we," "us" or "our"). is furnishing this proxy statement (the "Proxy Statement") and accompanying proxy card (or voting instruction form) to you in connection with the solicitation of proxies by the Board for the 2019 annual meeting of shareholders of the Company. The meeting will be held at Two Newton Place, 255 Washington Street, Suite 100, Newton, Massachusetts 02458 on Wednesday, April 25, 2018,24, 2019, at 1:30 p.m., Eastern time.

The mailing address of the Company's principal executive offices is Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458. The Company commenced mailingtime, and any adjournments or postponements thereof (the "2019 Annual Meeting"). We are first making these proxy materials available to its shareholders a Notice Regarding the Availability of Proxy Materials containing instructions on how to access the Company's Proxy Statement and its 2017 Annual Report on Form 10-K on or about February 23, 2018.

All properly executed written proxies, and all properly completed proxies submitted by telephone or internet, that are delivered pursuant to this solicitation will be voted at the 2018 Annual Meeting in accordance with the directions given in the proxy, unless the proxy is revoked prior to it being exercised at the meeting. These proxies also may be voted at any postponements or adjournments of the meeting.March 8, 2019.

Only owners of record of common shares of beneficial interest par value $0.01 per share, of the Company ("Common Shares") as of the close of business on February 1, 2018,January 31, 2019, the record date for the meeting, (the "Record Date"), are entitled to notice of, and to vote at, the meeting and at any postponements or adjournments of the meeting. Holders of Common Shares are entitled to one vote for each Common Share held on the Record Date.record date. On February 1, 2018,January 31, 2019, there were 3,126,4393,178,817 Common Shares issued and outstanding.

The mailing address of the Company's principal executive offices is Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE 20182019 ANNUAL MEETING TO BE HELD ON WEDNESDAY, APRIL 25, 2018.24, 2019.

The Notice of 20182019 Annual Meeting, Proxy Statement and Annual Report to Shareholders for the year ended December 31, 20172018 are available at www.proxyvote.com.

TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 5

QUESTIONS AND ANSWERS

Proxy Materials and Voting Information

1. What is included in the proxy materials? What is a proxy statement and what is a proxy? |

The proxy materials for the 20182019 Annual Meeting include the Notice Regarding the Availability of Proxy Materials, Notice of 20182019 Annual Meeting, this Proxy Statement and the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 20172018 (the "Annual Report" and, together with the other materials, the "proxy materials"). If you request a paper copy of these materials, the proxy materials will also include a proxy card or voting instruction form.

A proxy statement is a document that the Securities and Exchange Commission ("SEC") regulations require the Company to give you when it asks you to return a proxy designating individuals to vote on your behalf. A proxy is your legal designation of another person to vote the shares you own. That other person is called your proxy. We are asking you to designate the following three persons as your proxies for the 20182019 Annual Meeting: David M. Blackman, Managing Trustee and Chief Executive Officer; Jennifer B. Clark, Secretary; and Adam D. Portnoy, Managing Trustee.

2. What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

If your shares are registered directly in your name with the Company's registrar and transfer agent, Equiniti Trust Company (formerly known as Wells Fargo Shareowner Services),Services, you are considered a shareholder of record of those shares. If you are a shareholder of record, you should receive only one notice or proxy card for all the Common Shares you hold in certificate form and in book entry form.

If your shares are held in an account you own at a bank or brokerage or you hold shares through another nominee, you are considered the "beneficial owner" of those shares. If you are a beneficial owner, you will receive voting instruction information from the bank, broker or other nominee through which you own your Common Shares.

If you hold some shares of record and some shares beneficially, you should receive a notice or proxy card for all the Common Shares you hold of record and a separate voting instruction form for the shares from the bank, broker or other nominee through which you own Common Shares.

3. What different methods can I use to vote? |

By Written Proxy. All shareholders of record can submit voting instructions by written proxy card. If you are a shareholder of record and receive a Notice Regarding the Availability of Proxy Materials, you may request a written proxy card by following the instructions included in the notice. If you are a beneficial owner, you may request a written proxy card or a voting instruction form from your bank, broker or other nominee. Proxies submitted by mail must be received by 11:59 p.m., Eastern time, on April 24, 201823, 2019 or, if the meeting is postponed or adjourned to a later date, by 11:59 p.m., Eastern time, on the day immediately preceding the date of the reconvened meeting.

By Telephone or Internet. All shareholders of record also can authorize a proxy to vote their shares by touchtone telephone by calling 1-800-690-6903, or through the internet at www.proxyvote.com, using the procedures and instructions described in your Notice Regarding the Availability of Proxy Materials or

6 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement

proxy card. Beneficial owners may authorize a proxy by telephone or internet if their bank, broker or other nominee makes those methods available, in which case the bank, broker or nominee will include the instructions with the proxy voting materials. To authorize a proxy by telephone or internet, you will need the 16 digit control number provided on your Notice Regarding the Availability of Proxy Materials, proxy card or voting instruction form. The telephone and internet proxy authorization procedures are designed to authenticate shareholder identities, to allow shareholders to vote their shares and to confirm that their instructions have been recorded properly. Proxies submitted by telephone or through the internet must be received by 11:59 p.m., Eastern time, on April 24, 201823, 2019 or, if the meeting is postponed or adjourned to a later date, by 11:59 p.m., Eastern time, on the day immediately preceding the date of the reconvened meeting.

In Person. All shareholders of record may vote in person at the meeting. Beneficial owners may vote in person at the meeting if they have a legal proxy, as described in the response toquestion 1512.

4. Who may vote at the |

Holders of record of Common Shares as of the close of business on February 1, 2018,January 31, 2019, the Record Date,record date, may vote at the meeting. Holders of Common Shares are entitled to one vote for each Common Share held on the Record Date.record date.

5. What |

| ||||

| ||||

|

If you returnsubmit a signed proxy card or authorize a proxy by internet or telephone, andbut do not specify a choice for a matter, you will be instructingindicate how your proxy to vote in the manner recommended by the Board on that matter:

TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement 7

|

If you are a beneficial owner and do not provide voting instructions to your bank, broker or other nominee, the following applies:

Non-Discretionary Items. The election of Trustees is a non-discretionary item and may notCommon Shares should be voted on by brokers, banksone or other nominees who have not received specific voting instructions from beneficial owners. The resultmore proposals, then the proxies will vote your shares as the Board of Trustees recommends on those proposals. Other than the inability of a broker, bank or other nominee to voteproposals listed on a non-discretionary item for which it has not received specific voting instructions from beneficial owners is referred to as a broker non-vote.

Discretionary Items. The ratification of the appointment of Ernst & Young LLP as independent auditors is a discretionary item. Generally, banks, brokerspages 11 and other nominees that42, we do not receive voting instructions from beneficial ownersknow of any other matters to be presented at the meeting. If any other matters are properly presented at the meeting, the proxies may vote on this proposalyour shares in accordance with their discretion.best judgment.

|

A quorum of shareholders is required for shareholders to take action at the 20182019 Annual Meeting. The presence, in person or by proxy, of shareholders entitled to cast a majority of all the votes entitled to be cast at the 20182019 Annual Meeting constitutes a quorum.

Abstentions and broker non-votes are included in determining whether a quorum is present. Abstentions are not votes cast and, therefore, will not be included in vote totals and will have no effect on the outcome of either ItemItems 1 or 2 to be voted on at the 20182019 Annual Meeting. A proxy marked "WITHHOLD" with respect to Item 1 will have the same effect as an abstention. Broker non-votes are not votes cast and, therefore, will not be included in vote totals and will have no effect on the outcome of Item 1. There can be no broker non-votes on Item 2 as it is a matter on which, if you hold your shares in street name and do not provide voting instructions to the broker, bank or other nominee that holds your shares, the nominee has discretionary authority to vote on your behalf.

|

Shareholders have the right to revoke a proxy at any time before it is voted at the 20182019 Annual Meeting, subject to the proxy voting deadlines described above. Shareholders may revoke a proxy by authorizing a proxy again on a later date by internet or by telephone (only the last internet or telephone proxy submitted

TREMONT MORTGAGE TRUST![]() 2019 Proxy Statement 7

2019 Proxy Statement 7

prior to the meeting will be counted) or by signing and returning a later dated proxy card or by attending the meeting and voting in person. If you are a beneficial owner, see the response toquestion 1512.

A shareholder's attendance at the 20182019 Annual Meeting will not revoke that shareholder's proxy unless that shareholder votes again at the meeting or sends an original written statement to the Secretary of the Company revoking the prior proxy. An original written notice of revocation or subsequent proxy should be delivered to Tremont Mortgage Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458, Attention: Secretary, or hand delivered to the Secretary before the taking of the vote at the 20182019 Annual Meeting.

Beneficial owners who wish to change their votes should contact the organization that holds their shares.

8 TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement

|

The Notice of 20182019 Annual Meeting, this Proxy Statement and the Annual Report are available at www.proxyvote.com. You may access these proxy materials on the internet through the conclusion of the 20182019 Annual Meeting.

Instead of receiving future copies of the Company's proxy materials by mail, shareholders of record and most beneficial owners may elect to receive these materials electronically. Opting to receive your future proxy materials electronically will save us the cost of printing and mailing documents, and also will give you an electronic link to our proxy voting site. Your Notice Regarding the Availability of Proxy Materials instructs you as to how you may request electronic delivery of future proxy materials.

|

The Company will report the final results in a Current Report on Form 8-K filed with the SEC following the completion of the 2018 Annual Meeting.

|

The Company bears all expenses incurred in connection with the solicitation of proxies. We will request banks, brokers and other nominees to forward proxy materials to the beneficial owners of Common Shares and to obtain their voting instructions. We will reimburse those firms for their expenses of forwarding proxy materials.

Proxies willmay also be solicited, without additional compensation, by the Company's Trustees and officers, and by The RMR Group LLC ("RMR LLC"), its officers and employees and its parent's and subsidiaries', including our manager, Tremont Realty Advisors LLCLLC's ("TRA"), directors, officers and employees, by mail, telephone or other electronic means or in person.

|

As permitted by the Securities Exchange Act of 1934, as amended (the "Exchange Act"), we may deliver only one copy of the Notice Regarding the Availability of Proxy Materials, Notice of 20182019 Annual Meeting, this Proxy Statement and the Annual Report to Shareholders residing at the same address, unless the shareholders have notified us of their desire to receive multiple copies of those documents. This practice is known as "householding."

We will deliver a separate copy of any of those documents to you if you write to the Company at Investor Relations, Tremont Mortgage Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458, or call the Company at (617) 796-8317. If you want to receive separate copies of our notices regarding the availability of proxy materials, notices of annual meetings, proxy statements and annual reports in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker or other nominee, or you may contact us at the above address or telephone number.

8 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 9

20182019 Annual Meeting Information

|

IMPORTANT NOTE: If you plan to attend the 2018 Annual Meeting, you must follow these instructions to ensure admission.

All attendees need to bring photo identification for admission. Please note that cameras and audio or video recorders are not permitted at the meeting. Any cell phones, pagers or similar electronic devices must be shut off for the duration of the meeting.

Attendance at the meeting is limited to the Company's Trustees and officers, shareholders as of the Record Date (February 1, 2018)record date (January 31, 2019) or their duly authorized representatives or proxies, and other persons permitted by the Chairman of the meeting. All attendees need to bring photo identification for admission.

Record owners:

If you are a shareholder as of theBeneficial owners: If you are a shareholder as of the Record Daterecord date who holds shares indirectly through a brokerage firm, bank or other nominee, you may be required tomust present evidence of your beneficial ownership of shares. For this purpose, a copy of a letter or account statement from the applicable brokerage firm, bank or other nominee confirming such ownership will be acceptable.acceptable and such copy may be retained by the Company. Please note that you will not be able to vote your shares at the meeting without a legal proxy, as described in the response toquestion 1512.

10 TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement

If you have questions regarding these admission procedures, please call Investor Relations at (617) 796-7651.

|

If you are a beneficial owner and want to vote your shares at the 20182019 Annual Meeting, you need a legal proxy from your bank, broker or other nominee. You also need to follow the procedures described in the response toquestion 1411 and to bring the legal proxy with you to the meeting and hand it in with a signed ballot that will be provided to you at the meeting. You will not be able to vote your shares at the meeting without a legal proxy. If you do not have a legal proxy, you can still attend the meeting by following the procedures described in the response toquestion 1411. However, you will not be able to vote your shares at the meeting without a legal proxy. The Company encourages you to vote your shares in advance, even if you intend to attend the meeting.

Company Documents, Communications and Shareholder Proposals

|

You can visit our website to view our Governance Guidelines, Board committee charters and Code of Business Conduct and Ethics (the "Code"). To view these documents, go to www.trmtreit.com, click on "Investors" and then click on "Governance." To view the Company's SEC filings and Forms 3, 4 and 5 filed by the Company's Trustees and executive officers, go to www.trmtreit.com, click on "Investors," and then click on "Financial Information".Information."

We will deliver free of charge, upon request, a copy of the Company's Governance Guidelines, Board committee charters, Code or Annual Report to any shareholder requesting a copy. Requests should be directed to Investor Relations at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

TREMONT MORTGAGE TRUST![]() 2019 Proxy Statement 9

2019 Proxy Statement 9

|

Any shareholder or other interested person who wants to communicate with the Company's Trustees, individually or as a group, should write to the party for whom the communication is intended, c/o Secretary, Tremont Mortgage Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458 or email secretary@trmtreit.com. The communication will then be delivered to the appropriate party or parties.

|

A proposal for action to be presented by any shareholder at the Company's 20192020 annual meeting of shareholders must be submitted as follows:

TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement 11

Proposals should be sent to the Company's Secretary at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

For additional information regarding how to submit a shareholder proposal, see page 3229 of this Proxy Statement.

1210 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement

ELECTION OF TRUSTEES (ITEM 1)

The Board serves as the decision making body of the Company, except for those matters reserved to the shareholders. The Board selects and oversees the Company's officers, who are charged by the Board with conducting the day to day business of the Company.

Election Process |

In accordance with our Amended and Restated Declaration of Trust (our "Declaration of Trust") and Bylaws, the Board currently consists of five members, three of whom are Independent Trustees and two of whom are Managing Trustees. Our Declaration of Trust provides that the Board is divided into three classes, with Trustees of each class serving for a term that expires at the third annual meeting of shareholders following his or her election and until his or her successor is duly elected and qualifies.

Assuming a quorum is present at the meeting, aA plurality of all the votes cast at the meeting at which a quorum is present is required to elect a Trustee at the 20182019 Annual Meeting.

|

The Nominating and Governance Committee is responsible for identifying and evaluating nominees for Trustee and for recommending to the Board nominees for election at each annual meeting of shareholders. The Nominating and Governance Committee may consider candidates suggested by the Company's Trustees, officers or shareholders or by others.

Shareholder Recommendations for Nominees. Shareholders who would like to recommend a nominee for the position of Trustee should submit their recommendations in writing by mail to the Chair of the Nominating and Governance Committee, c/o Tremont Mortgage Trust, Secretary, at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458 or by email to secretary@trmtreit.com. A shareholder's recommendation should include any information that the recommending shareholder believes relevant to the Nominating and Governance Committee's consideration. The Nominating and Governance Committee may request additional information about the shareholder recommended nominee or about the shareholder recommending the nominee. Recommendations by shareholders will be considered by the Nominating and Governance Committee in its discretion using the same criteria as other candidates it considers.

Shareholder Nominations for Trustee. Our Bylaws also provide that a shareholder of the Company may nominate a person for election to the Board provided the shareholder complies with the advance notice provisions set forth in our Bylaws, which include, among other things, requirements as to the proposing shareholder's timely delivery of advance notice, continuous requisite ownership of Common Shares and submission of specified documentation and information. For more information on how shareholders can nominate Trustees for election to the Board, see "Shareholder Nominations and Other Proposals" on page 32.

Trustee Qualifications |

Trustees are responsible for overseeing the Company's business. This significant responsibility requires highly skilled individuals with various qualities, attributes and professional experience. The Board believes that there are general requirements that are applicable to all Trustees, qualifications applicable to Independent Trustees and other skills and experience that should be represented on the Board as a whole, but not necessarily by each Trustee. In accordance with our Declaration of Trust and Bylaws, the Board consists of five Trustees: two Managing Trustees and three Independent Trustees. As set forth in our Declaration of Trust, Independent Trustees are Trustees who are not employees of TRA or RMR LLC, who are not involved in the Company's day to day activities and who meet the qualifications of

TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement 13

independent directors under the applicable rules and requirements of The Nasdaq Stock Market LLC (the "Nasdaq") and the SEC. As set forth in our Declaration of Trust, Managing Trustees are Trustees who have been employees, officers or directors of TRA or RMR LLC or involved in the Company's day to day activities for at least one year prior to their election as Trustees. The Board and the Nominating and Governance Committee consider the qualifications of Trustees and Trustee candidates individually and in the broader context of the Board's overall composition and the Company's current and future needs.

Qualifications for All Trustees

In its assessment of each potential candidate, including those recommended by shareholders, the Nominating and Governance Committee considers the potential nominee's integrity, experience, achievements, judgment, intelligence, competence, personal character, likelihood that a candidate will be able to serve on the Board for an extended period and other matters that the Nominating and Governance Committee deems appropriate. The Nominating and Governance Committee also takes into account the ability of a potential nominee to devote the time and effort necessary to fulfill his or her responsibilities to the Company.

The Board and Nominating and Governance Committee require that each Trustee candidate be a person of high integrity with a proven record of success in his or her field. Each Trustee candidate must demonstrate the ability to make independent analytical inquiries, familiarity with and respect for corporate governance requirements and practices and a commitment to serving the Company's long term best interests. In addition, the Nominating and Governance Committee may conduct interviews of potential Trustee candidates to assess intangible qualities, including the individual's ability to ask appropriate questions and to work collegially. The Board does not have a specific diversity policy in connection with the selection of nominees for Trustee, but due consideration is given to the Board's overall balance of diversity, including perspectives, backgrounds and experiences.

14 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 11

Specific Qualifications, Attributes, Skills and Experience to be Represented on the Board

The Board has identified particular qualifications, attributes, skills and experience that are important to be represented on the Board as a whole, in light of the Company's long term interests. The following table summarizes certain key characteristics of the Company's business and the associated qualifications, attributes, skills and experience that the Board believes should be represented on the Board.

| Business Characteristics | Qualifications, Attributes, Skills and Experience | |

|---|---|---|

| | | |

| The Board's responsibilities include understanding and overseeing the various risks facing the Company and ensuring that appropriate policies and procedures are in place to effectively manage those risks. | • Risk oversight/management expertise. • Service on other public company boards and committees. • Operating business experience. | |

| | | |

| The Company's business involves complex financial and real estate transactions. | • High level of financial literacy. • Knowledge of the commercial real estate ("CRE") industry, CRE debt financing and real estate investment trusts ("REITs"). • Management/leadership experience. • Knowledge of the Company's business activities. • Familiarity with the public capital markets. • Work experience. | |

| | | |

| The Board must constantly evaluate the Company's strategic direction in light of current real estate trends. | • Experience at a strategic or policymaking level in a business, government, non-profit or academic organization of high standing. • Commitment to serve on the Board over a period of years in order to develop knowledge about the Company's operations. • Understanding of the impact of financial market trends on the real estate industry. | |

| | | |

| The Board meets frequently and, at times, on short notice to consider time sensitive issues. | • Sufficient time and availability to devote to Board and committee matters. • Practical wisdom and mature judgment. | |

| | | |

| The Board will be better informed if the members of the Board have diverse perspectives, backgrounds and experiences. | • Gender and ethnic diversity. • Nationality. • Experience. | |

| | | |

| The Board is comprised of two Managing Trustees and three Independent Trustees. | • Qualifying as a Managing Trustee in accordance with the requirements of our Declaration of Trust. • Qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our Declaration of Trust. | |

| | | |

12 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 15

|

The following table sets forth the names of the Trustee nominees and those Trustees who will continue to serve after the 20182019 Annual Meeting:

| Name | Position | Class | Current Term Expires | |||

|---|---|---|---|---|---|---|

| | | | | | | |

| Independent | ||||||

| II | 2019 | |||||

| II | 2019 | |||||

| Joseph L. Morea | Independent Trustee | III | 2020 | |||

| David M. Blackman | Managing Trustee | I | 2021 | |||

| Jeffrey P. Somers | Independent Trustee | I | 2021 | |||

| | | | | | | |

Upon the recommendation of the Nominating and Governance Committee, the Board has nominated Mr. Barry M.John L. Harrington for election as an Independent Trustee in Class II and Mr. Adam D. Portnoy for election as a Managing Trustee in Class III. Messrs. Harrington and Mr. Jeffrey P. Somers for election as an Independent Trustee in Class I. Messrs. Portnoy and Somers currently serve on the Board. If elected, each of Messrs. PortnoyHarrington and SomersPortnoy would serve until the Company's 20212022 annual meeting of shareholders and until his successor is duly elected and qualifies, subject to the individual's earlier death, resignation, retirement, disqualification or removal.

We expect that each nominee for election as a Trustee will be able to serve if elected. However, if a nominee should become unable or unwilling to serve, proxies may be voted for the election of a substitute nominee designated by the Board.

The Board believes that the combination of the various qualifications, attributes, skills and experiences of the Trustee nominees would contribute to an effective Board serving the Company's long term best interests. The Board and the Nominating and Governance Committee believe that the Trustee nominees possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company's management. Below is a summary of the key experiences, qualifications, attributes and skills that led the Nominating and Governance Committee and the Board to conclude such person is currently qualified to serve as a Trustee.

The Board of Trustees recommends a vote "FOR" the election of both Trustee nominees.

Trustees and Executive Officers |

The following is some important biographical information, including the ages and recent principal occupations, as of FebruaryMarch 1, 2018,2019, of the Company's Trustees, Trustee nominees and executive officers. The business address of the Trustees, Trustee nominees and executive officers is c/o Tremont Mortgage Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458. Included in each Trustee's biography below are the attributes of that Trustee consistent with the qualifications, attributes, skills and experience the Board has determined are important to be represented on the Board. For a general discussion of the particular Trustee qualifications, attributes, skills and experience, and the process for selecting and nominating individuals for election to serve as a Trustee, please see "Election of Trustees" beginning on page 13.11.

16 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 13

Trustee Nominees

Barry M. Portnoy

|

| |||||||

TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement 17

Jeffrey P. Somers

|

| |||||||

18 TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement

Trustees

Adam D. Portnoy

|

| |||||||

TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement 19

John L. Harrington

|

| Independent Trustee since 2017 Class/Term: Class II with a term expiring at the 2019 Age: Board Committees: Audit; Compensation (Chair); Nominating and Governance Other Public Company Boards: Hospitality Properties Trust (since 1995); Senior Housing Properties Trust (since 1999); RMR Real Estate Income Fund, including its predecessor funds (since 2003); Office Properties Income Trust (formerly known as Government Properties Income Trust, Mr. Harrington has been chairman of the board of trustees of the Yawkey Foundation (a charitable foundation) since 2007 and prior to that from 2002 to 2003. He served as a trustee of the Yawkey Foundation since 1982 and as executive director from 1982 to 2006. He was also a trustee of the JRY Trust from 1982 through 2009. Mr. Harrington was chief executive officer and general partner of the Boston Red Sox Baseball Club from 1986 to 2002 and served as that organization's vice president and chief financial officer prior to that time. He was president of Boston Trust Management Corp. from 1981 to 2006 and a principal of Bingham McCutchen Sports Consulting LLC from 2007 to 2008. Mr. Harrington represented the Boston Red Sox majority interest in co-founding The New England Sports Network, managing it from 1981 to 2002. Mr. Harrington served as a director of Fleet Bank from 1995 to 1999 and of Shawmut Bank of Boston from 1986 to 1995, a member of the Major League Baseball Executive Council from 1998 to 2001, assistant secretary of administration and finance for the Commonwealth of Massachusetts in 1980, treasurer of the American League of Professional Baseball Clubs from 1970 to 1972, assistant professor and director of admissions, Carroll Graduate School of Management at Boston College from 1967 through 1970 and as supervisory auditor for the U.S. General Accounting Office from 1961 through 1966. He was an independent trustee of RMR Funds Series Trust from shortly after its formation in 2007 until its dissolution in 2009. Mr. Harrington has held many civic leadership positions and received numerous leadership awards and honorary doctorate degrees. Mr. Harrington holds a Massachusetts license as a certified public accountant. Specific Qualifications, Attributes, Skills and Experience: • demonstrated leadership capability; • work on public company boards and board committees and in key management roles in various enterprises; • service on the boards of several private and charitable organizations; • professional skills and expertise in accounting, finance and risk management and experience as a chief financial officer; • expertise in compensation and benefits matters; • institutional knowledge earned through prior service • qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our Declaration of Trust. | ||||||

2014 TREMONT MORTGAGE TRUST ![]() 2019 Proxy Statement

2019 Proxy Statement

Adam D. Portnoy

| Managing Trustee since 2017 Class/Term: Class II with a term expiring at the 2019 Annual Meeting Age: 48 Other Public Company Boards: Hospitality Properties Trust (since 2007); Senior Housing Properties Trust (since 2007); Office Properties Income Trust (formerly known as Government Properties Income Trust, since 2009); RMR Real Estate Income Fund, including its predecessor funds (since 2009); The RMR Group Inc. (since 2015); Industrial Logistics Properties Trust (since 2017); Five Star Senior Living Inc. (since 2018); TravelCenters of America LLC (since 2018) Mr. Portnoy has been president and chief executive officer of The RMR Group Inc. ("RMR Inc.") since shortly after its formation in 2015. Mr. Portnoy has been president and chief executive officer of RMR LLC since 2005 and was a director of RMR LLC from 2006 until June 5, 2015 when RMR LLC became a majority owned subsidiary of RMR Inc. and RMR Inc. became RMR LLC's managing member. Mr. Portnoy has been a director of RMR Advisors LLC since 2007 and served as its president from 2007 to September 2017 and its chief executive officer from 2015 to September 2017. Mr. Portnoy has been a director of TRA since March 2016, and served as its president and chief executive officer from March 2016 through December 2017. Mr. Portnoy is an owner, the sole trustee and an officer of ABP Trust. Mr. Portnoy is the majority owner and has been a director of Sonesta International Hotels Corporation since 2012. Mr. Portnoy served as president and chief executive officer of RMR Real Estate Income Fund from 2007 to 2015 and as president of Office Properties Income Trust from 2009 to 2011. Mr. Portnoy was a managing trustee of Select Income REIT from 2011 until it merged with a wholly owned subsidiary of Office Properties Income Trust in December 2018. Mr. Portnoy was a managing trustee of Equity Commonwealth from 2006 until 2014 and served as its president from 2011 to 2014. Prior to joining RMR LLC in 2003, Mr. Portnoy held various positions in the finance industry and public sector, including working as an investment banker at Donaldson, Lufkin & Jenrette and working in private equity at DLJ Merchant Banking Partners and at the International Finance Corporation (a member of The World Bank Group). In addition, Mr. Portnoy previously founded and served as chief executive officer of a privately financed telecommunications company. Mr. Portnoy currently serves as the Honorary Consul General of the Republic of Bulgaria to Massachusetts and on the Board of Directors of Pioneer Institute, and previously served on the board of governors for the National Association of Real Estate Investment Trusts and the board of trustees of Occidental College. Specific Qualifications, Attributes, Skills and Experience: • extensive experience in, and knowledge of, the asset management and CRE industries and REITs; • leadership position with TRA and RMR LLC and demonstrated management ability; • public company trustee and director service; • experience in investment banking and private equity; • institutional knowledge earned through prior service on the Board and in leadership positions with TRA and RMR LLC; and • qualifying as a Managing Trustee in accordance with the requirements of our Declaration of Trust. | |||||||

TREMONT MORTGAGE TRUST![]() 2019 Proxy Statement 15

2019 Proxy Statement 15

Trustees

David M. Blackman

| Managing Trustee since2018 Class/Term: Class I with a term expiring at the 2021 annual meeting of shareholders Age: 56 Other Public Company Boards: Office Properties Income Trust (since 2019) Mr. Blackman has been chief executive officer of the Company since shortly after our formation in 2017 and president since 2018. Mr. Blackman joined RMR LLC in 2009 as senior vice president, and he became executive vice president of RMR LLC in 2013. Mr. Blackman has been a director, president and chief executive officer of TRA since 2018, and an executive vice president of TRA from its formation in 2016 through December 2017. Mr. Blackman also has been president and chief executive officer of Office Properties Income Trust (formerly known as Government Properties Income Trust) since May 2018, and was previously its president and chief operating officer from 2011 until May 2018, and before then its chief financial officer and treasurer from 2009 through 2011. Mr. Blackman was a managing trustee and president and chief executive officer of Select Income REIT from 2018 until it merged with a wholly owned subsidiary of Office Properties Income Trust (then known as Government Properties Income Trust) in December 2018, and he was its president and chief operating officer from 2011 through April 2018. Prior to joining RMR LLC, Mr. Blackman was employed as a banker at Wachovia Corporation and its predecessors for 23 years, where he focused on real estate finance matters, including serving as a managing director in the real estate section of Wachovia Capital Markets, LLC from 2005 through 2009. Specific Qualifications, Attributes, Skills and Experience: • leadership position with the Company, TRA and RMR LLC and demonstrated management ability; • extensive experience in, and knowledge of, the CRE industry and REITs; • institutional knowledge earned through prior service as an executive officer of the Company and in leadership positions with TRA and RMR LLC; • professional skills and expertise in accounting and financing and experience as a chief executive officer, president, chief operating officer and chief financial officer of one or more public companies; and • qualifying as a Managing Trustee in accordance with the requirements of our Declaration of Trust. | |||||||

16 TREMONT MORTGAGE TRUST![]() 2019 Proxy Statement

2019 Proxy Statement

Joseph L. Morea

|

| Independent Trustee since 2017 Class/Term: Class III with a term expiring at the 2020 annual meeting of shareholders Age: Board Committees: Audit (Chair); Compensation; Nominating and Governance Other Public Company Boards: THL Credit Senior Loan Fund (since 2013); Eagle Growth & Income Opportunities Fund (since 2015); Garrison Capital Inc. (since 2015); TravelCenters of America LLC (since 2015); RMR Real Estate Income Fund (since 2016); Industrial Logistics Properties Trust (since 2018) Mr. Morea was a vice chairman and managing director, serving as head of U.S. Equity Capital Markets, at RBC Capital Markets, an international investment bank, from 2003 until 2012. From 2008 to 2009, Mr. Morea also served as the head of U.S. Investment Banking for RBC Capital Markets. Previously, Mr. Morea was employed as an investment banker, including as a managing director and the co-head of U.S. Equity Capital Markets at UBS, Inc., the chief operating officer of the Investment Banking Division and head of U.S. Equity Capital Markets at PaineWebber, Inc. and a managing director of Equity Capital Markets at Smith Barney, Inc. Prior to working as an investment banker, Mr. Morea was employed as a certified public accountant. Mr. Morea served as a trustee of Equity Commonwealth from 2012 until 2014. Specific Qualifications, Attributes, Skills and Experience: • experience in and knowledge of the investment banking industry and public capital markets; • demonstrated leadership and management abilities; • experience in capital raising and strategic business transactions; • experience as a public company trustee and director and board committee member; • professional training, skills and expertise in, among other things, finance matters; • institutional knowledge earned through prior service on the Board since shortly after our formation; and • qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our Declaration of Trust. | ||||||

TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 2117

Jeffrey P. Somers

| Independent Trustee since 2017 Class/Term: Class I with a term expiring at the 2021 annual meeting of shareholders Age: 76 Board Committees: Audit; Compensation; Nominating and Governance (Chair) Other Public Company Boards: Office Properties Income Trust (formerly known as Government Properties Income Trust, since 2009); RMR Real Estate Income Fund, including its predecessor funds (since 2009); Senior Housing Properties Trust (since 2009) Mr. Somers has been, since 2010, of counsel to, and from 1995 to 2009, was a member, and for six of those years the managing member, of the law firm of Morse, Barnes-Brown & Pendleton, PC. Prior to that time, he was a partner for more than 20 years at the law firm of Gadsby Hannah LLP (now McCarter & English, LLP) and for eight of those years was managing partner of the firm. Mr. Somers served as an independent trustee Select Income REIT from 2012 until it merged with a wholly owned subsidiary of Office Properties Income Trust (formerly known as Government Properties Income Trust) in December 2018. Mr. Somers served as a director for Cantella Management Corp., a holding company for Cantella & Co., Inc., an SEC registered broker-dealer, from 2002 until January 2014, when the company was acquired by a third party. From 1995 to 2001, he served as a trustee for the Pictet Funds. Before entering private law practice, Mr. Somers was a staff attorney at the SEC in Washington, D.C. He has previously served as a trustee for Glover Hospital, a private not for profit regional hospital, which is currently part of Beth Israel Deaconess Hospital, among various other civic leadership roles. Specific Qualifications, Attributes, Skills and Experience: • expertise in legal, corporate governance and regulatory matters; • leadership role as a law firm managing member; • service as a trustee of public investment companies; • extensive experience in complex business transactions; • sophisticated understanding of finance and accounting matters; • work on public company boards and board committees; • institutional knowledge earned through prior service on the Board since shortly after our formation; and • qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our Declaration of Trust. | |||||||

18 TREMONT MORTGAGE TRUST![]() 2019 Proxy Statement

2019 Proxy Statement

Executive Officers

David M. Blackman

| Chief Executive Officer since 2017 President since 2018 Age: Mr. | |||||||

Daniel O. Mee

|

| |||||||

Richard C. Gallitto

|

| |||||||

22 TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement

G. Douglas Lanois

| Chief Financial Officer and Treasurer since 2017 Age: Mr. Lanois has served as a vice president of | |||||||

Barry M. Portnoy is the father of Adam D. Portnoy. There are no other family relationships among any of the Company's Trustees or executive officers. The Company's executive officers serve at the discretion of the Board.

RMR LLC or its subsidiaries provide management services to public and private companies, including the Company, Government Properties Income Trust, Hospitality Properties Trust, Industrial Logistics Properties Trust, Select Income REIT, Senior Housing Properties Trust, Five Star Senior Living Inc., TravelCenters of America LLC, Sonesta International Hotels Corporation and Affiliates Insurance Company. Government Properties Income Trust is a public REIT that primarily invests in properties that are majority leased to government tenants and office properties in the metropolitan Washington, D.C. market area that are leased to government and private sector tenants ("GOV"). Hospitality Properties Trust is a public REIT that owns hotels and travel centers ("HPT"). Industrial Logistics Properties Trust is a public REIT that owns industrial and logistics properties ("ILPT"). Select Income REIT is a public REIT that primarily owns net leased, single tenant properties ("SIR"). Senior Housing Properties Trust is a public REIT that primarily owns healthcare, senior living and medical office buildings ("SNH"). Five Star Senior Living Inc. is a public real estate based operating company in the healthcare and senior living services business ("FVE"). TravelCenters of America LLC is a public real estate based operating company in the travel center, convenience store and restaurant businesses ("TA"). Sonesta International Hotels Corporation is a private company that operates and franchises hotels, resorts and cruise ships ("Sonesta"). Affiliates Insurance Company is a private Indiana insurance company ("AIC"). RMR LLC is a majority owned subsidiary of RMR Inc., a public company whose controlling shareholder is ABP Trust, which is owned by our Managing Trustees and to which RMR LLC provides management services. RMR Advisors LLC, a subsidiary of RMR LLC, is an SEC registered investment adviser to the RMR Real Estate Income Fund, which is an investment company registered under the Investment Company Act of 1940, as amended ("RIF"). TRA, a subsidiary of RMR LLC, is an SEC registered investment adviser that provides investment advisory services to its investment advisory clients, which include the Company, a private fund and separately managed accounts that invest in CRE debt, including secured mortgage debt and mezzanine financing opportunities. TRA also provides management services to certain of its investment advisory clients, including originating, underwriting, closing and managing certain real estate loans or other real estate investments. TRA, as an intermediary, also provides mortgage brokerage services, originating and arranging CRE loans for third parties who are not investment advisory clients. The foregoing entities may be considered to be affiliates of the Company.

TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 2319

Trustee Nominations |

The Nominating and Governance Committee is responsible for identifying and evaluating nominees for Trustee and for recommending to the Board nominees for election at each annual meeting of shareholders. The Nominating and Governance Committee may consider candidates suggested by the Company's Trustees, officers or shareholders or by others.

Shareholder Recommendations for Nominees. Shareholders who would like to recommend a nominee for the position of Trustee should submit their recommendations in writing by mail to the Chair of the Nominating and Governance Committee, c/o Tremont Mortgage Trust, Secretary, at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458 or by email to secretary@trmtreit.com. A shareholder's recommendation should include any information that the recommending shareholder believes relevant to the Nominating and Governance Committee's consideration. The Nominating and Governance Committee may request additional information about the shareholder recommended nominee or about the shareholder recommending the nominee. Recommendations by shareholders will be considered by the Nominating and Governance Committee in its discretion using the same criteria as other candidates it considers.

Shareholder Nominations for Trustee. Our Bylaws also provide that a shareholder of the Company may nominate a person for election to the Board provided the shareholder complies with the advance notice provisions set forth in our Bylaws, which include, among other things, requirements as to the proposing shareholder's timely delivery of advance notice, continuous requisite ownership of Common Shares and submission of specified documentation and information. For more information on how shareholders can nominate Trustees for election to the Board, see "Shareholder Nominations and Other Proposals" on page 29.

20 TREMONT MORTGAGE TRUST![]() 2019 Proxy Statement

2019 Proxy Statement

TRUSTEE COMPENSATION

The Compensation Committee is responsible for reviewing and determining the Common Share awards granted to Trustees and making recommendations to the Board regarding cash compensation paid to Trustees, in each case, for Board, committee and committee chair services. Managing Trustees do not receive cash compensation for their services as Trustees but do receive Common Share awards for their Board service. The number of Common Shares awarded to each Managing Trustee for Board service is the same as the number awarded to each Independent Trustee.

In determining the amount and composition of our Trustees' compensation, the Compensation Committee and the Board take various factors into consideration, including, but not limited to, the responsibilities of Trustees generally, as well as for service on committees and as committee chairs, and the forms of compensation paid to trustees or directors by comparable companies, including the compensation of trustees and directors of other companies managed by RMR LLC or its subsidiaries. The Board reviews the Compensation Committee's recommendations regarding Trustee cash compensation and determines the amount of such compensation.

|

EachIn 2018, each Independent Trustee receivesreceived an annual fee of $20,000 for services as a Trustee, plus a fee of $500 for each meeting attended. The annual fee for new Independent Trustees is prorated for the initial year. Up to two $500 fees arewere paid if a Board meeting and one or more Board committee meetings, or two or more Board committee meetings, arewere held on the same date. Each Independent Trustee and Managing Trustee received an annual award of 1,5003,000 Common Shares in 2017.2018.

Each Independent Trustee who servesserved as a committee chair of the Board's Audit, Compensation or Nominating and Governance Committees receivesreceived an additional annual fee of $7,500, $5,000 and $5,000, respectively. The committee chair fee for any new Independent Trustee is prorated for the initial year. Trustees arewere reimbursed for travel expenses they incurincurred in connection with their duties as Trustees and for out of pocket costs they incurincurred in connection with their attending certain continuing education programs.

The following table details the total compensation of the Trustees for the year ended December 31, 20172018 for services as a Trustee.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | All Other Compensation ($) | Total ($) | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | All Other Compensation ($) | Total ($) | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

David M. Blackman(3)(4) | $ | — | $ | 57,795 | $ | — | $ | 57,795 | ||||||||||||||||||

John L. Harrington | $ | 17,667 | $ | 23,805 | $ | — | $ | 41,472 | 33,500 | 37,830 | — | 71,330 | ||||||||||||||

Joseph L. Morea | 19,333 | 23,805 | — | 43,138 | | 35,500 | | 37,830 | | — | | 73,330 | ||||||||||||||

Adam D. Portnoy(3) | | — | | 23,805 | | — | | 23,805 | — | 37,830 | — | 37,830 | ||||||||||||||

Barry M. Portnoy(3) | — | 23,805 | — | 23,805 | ||||||||||||||||||||||

Barry M. Portnoy(3)(4) | | — | | — | | — | | — | ||||||||||||||||||

Jeffrey P. Somers | | 17,667 | | 23,805 | | — | | 41,472 | 33,000 | 37,830 | — | 70,830 | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

24 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 21

CORPORATE GOVERNANCE

The Board is committed to corporate governance that promotes the long term interests of our shareholders. The Board has established Governance Guidelines that provide a framework for effective governance. The guidelines address matters such as general qualification standards for the Board, Trustee responsibilities, Board meetings and communications, Board committees, Trustee access to management and independent advisers, Trustee compensation, Trustee orientation and continuing education, executive development and succession planning, related person transactions, annual performance evaluation of the Board and other matters. The Board regularly reviews developments in corporate governance and updates our Governance Guidelines and other governance materials as it deems necessary and appropriate.

The governance section of our website makes available our corporate governance materials, including the Governance Guidelines, the charter for each Board committee and the Code and information about how to report matters directly to management, the Board or the Audit Committee.Code. To access these documents on the Company's website, www.trmtreit.com, click on "Investors" and then click on "Governance." In addition, instructions on how to obtain copies of the Company's corporate governance materials are included in the response toquestion 1613 in the "Questions and Answers" section on page 11.9.

Board Leadership Structure |

In accordance with our Declaration of Trust and Bylaws, the Board is comprised of five Trustees, including three Independent Trustees and two Managing Trustees. All Trustees play an active role in overseeing the Company's business both at the Board and committee levels. As set forth in the Company's Governance Guidelines, the core responsibility of our Trustees is to exercise sound, informed and independent business judgment in overseeing the Company and its strategic direction. Our Trustees are skilled and experienced leaders and currently serve or have served as members of senior management in public and private for profit organizations and law firms, and have also served in academia. Our Trustees may be called upon to provide solutions to various complex issues and are expected to, and do, ask hard questions of the Company's officers and advisors. The Board is small, which facilitates informal discussions and communication from management to the Board and among Trustees.

We do not have a Chairman of the Board or a lead Independent Trustee. Our Chief Executive Officer, Co-President and Chief Operating Officer, Co-President and Chief Investment Officer, and Chief Financial Officer and Treasurer areis not membersa member of the Board, but theyhe and our Director of Internal Audit regularly attend Board and Board committee meetings, as does our Director of Internal Audit.meetings. Other officers of TRA and RMR LLC also sometimes attend Board meetings at the invitation of the Board. Special meetings of the Board may be called at any time by any Managing Trustee, the Chief Executive Officer or any Co-President or the Secretary pursuant to the request of any two Trustees then in office. Our Managing Trustees, in consultation with the Company's management and the Director of Internal Audit, set the agenda for Board meetings. Other Trustees may suggest agenda items. Discussions at Board meetings are led by the Managing Trustee or Independent Trustee who is most knowledgeable on a subject.

Pursuant to the Company's Governance Guidelines, the Company's Independent Trustees are expected to meet in regularly scheduled meetings at which only Independent Trustees are present. It is expected that these executive sessions may occur at least twice per year. Our Independent Trustees also meet separately with the Company's officers, with the Company's Director of Internal Audit and with the Company's independent auditors. The presiding Trustee for purposes of leading Independent Trustee sessions is the Chair of the Audit Committee unless the Independent Trustees determine otherwise.

In 2017,2018, the Board held twoeight meetings. In 2017,2018, each Trustee attended 75% or more of the aggregate of all meetings of the Board and the committees on which he served or that were held during the period in

TREMONT MORTGAGE TRUST![]()

2018 Proxy Statement 25

which he served as a Trustee or committee member. The Company's policy with respect to Board members' attendance at meetings of the Board and annual meetings of shareholders can be found in the Company's Governance Guidelines, the full text of which appears at the Company's website, www.trmtreit.com.

22 TREMONT MORTGAGE TRUST![]() 2019 Proxy Statement

2019 Proxy Statement

Independence of Trustees |

Under the corporate governance listing standards of the Nasdaq, the Board must consist of a majority of Independent Trustees. To be considered independent:

Our Bylaws also require that a majority of the Board be Independent Trustees. Under our Declaration of Trust, Independent Trustees are Trustees who are not employees of TRA or RMR LLC, are not involved in the Company's day to day activities and who meet the qualifications of independent directors under the applicable rules of the Nasdaq and the SEC.

The Board affirmatively determines whether Trustees have a direct or indirect material relationship with the Company, including the Company's subsidiaries, other than serving as the Company's Trustees or trustees or directors of the Company's subsidiaries. In making independence determinations, the Board observes the Nasdaq and SEC criteria, as well as the criteria in our Bylaws. When assessing a Trustee's relationship with the Company, the Board considers all relevant facts and circumstances, not merely from the Trustee's standpoint, but also from that of the persons or organizations with which the Trustee has an affiliation. Based on this review, the Board has determined that John L. Harrington, Joseph L. Morea and Jeffrey P. Somers currently qualify as independent trustees under applicable Nasdaq and SEC criteria and as Independent Trustees under our Bylaws. In making these independence determinations, the Board reviewed and discussed additional information provided by the Trustees and the Company with regard to each of the Trustees' relationships with the Company, TRA, RMR Inc.LLC or RMR LLCInc. and the other companies to which RMR LLC or its subsidiaries provide management and advisory services. The Board has concluded that none of these three Trustees possessed or currently possesses any relationship that could impair his or her judgment in connection with his or her duties and responsibilities as a Trustee or that could otherwise be a direct or indirect material relationship under applicable Nasdaq and SEC standards.

Board Committees |

The Board has an Audit Committee, Compensation Committee and Nominating and Governance Committee. The Audit Committee, Compensation Committee and Nominating and Governance Committee have each adopted a written charter, which is available on the Company's website, www.trmtreit.com, by clicking on "Investors" and then clicking on "Governance." Shareholders may also request copies free of charge by writing to Investor Relations, Tremont Mortgage Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

Our Audit Committee, Compensation Committee and Nominating and Governance Committee are comprised entirely of Independent Trustees, and an Independent Trustee serves as Chair of each committee. The Director of Internal Audit, with the assistance of Company management, proposes the agenda for committee meetings under the oversight and direction of the Committee Chairs. Additionally, the charter of each of our Audit Committee, Compensation Committee and Nominating and Governance Committee provides that the committee may form and delegate authority to subcommittees of one or more members when appropriate. Subcommittees are subject to the provisions of the applicable committee's charter. Additional information about the committees is provided below.

26 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 23

| Joseph L. Morea Committee Chair |

"The Audit Committee is dedicated to maintaining the integrity of the Company's financial reporting; monitoring and mitigating the Company's financial risk exposure; selecting, assessing the independence and performance of, and working productively with, the Company's independent auditors; overseeing and collaborating with the Company's internal audit function; and monitoring the Company's legal and regulatory compliance."

Additional Committee Members: John L. Harrington and Jeffrey P. Somers

Meetings Held in 2017:2018: 18

Purpose and Primary Responsibilities:Role:

The Audit Committee was established in accordance with Section 3(a)(58)(A)is comprised solely of the Exchange Act. The purpose of the Audit CommitteeIndependent Trustees. Its primary role is to assist the Board in fulfilling its responsibilities for oversight of: (1) the Company's accounting and financial reporting processes; (2) the audits of the Company's financial statements and internal control over financial reporting; (3) the Company's compliance with legal and regulatory requirements; and (4) the Company's internal audit function generally. The Audit Committee takes a leading role in helpinghelp the Board fulfill its oversight responsibilities for oversightrelated to the integrity of the Company'sour financial statements and financial reporting process, the qualifications, independence and performance of our independent registered public accounting firm, the performance of our internal audit function, risk management and the Company'sour compliance with legal and regulatory requirements. Under its charter, theThe Audit Committee is directly responsible for the appointment, compensation, retention and oversight, and the evaluation of the qualifications, performance and independence, of the Company's independent auditor and the resolution of disagreements between management and the independent auditor regarding financial reporting. The Audit Committee reviews the overall audit scope and plans of the audit with the independent auditor. The independent auditor reports directly to the Audit Committee. The Audit Committee also has final authority and responsibility for the appointment and assignment of duties to the Director of Internal Audit. The Audit Committee reviews the overall audit scope and plans of the audit with the independent auditor. The Audit Committee also reviews with management and the independent auditors the Company's quarterly reports on Form 10-Q, yearlyannual reports on Form 10-K and earnings releases. The Audit Committee reviews and assesses the adequacy of its charter at least annually and, when appropriate, recommends changes to the Board.

Independence:Each member of the Audit Committee meets the independence requirements of the Nasdaq, the Exchange Act and the Company's Governance Guidelines.

Financial Literacy and Expert:EachThe Board has determined that each member of the Audit Committee is financially literate knowledgeable and qualified to review financial statements. The Board has determined that Mr. Harrington is the Audit Committee's "financial expert" and is independent as defined by the rules of the SEC and the Nasdaq. The Board's determination that Mr. Harrington is a financial expert was based on his experience as: (i) executive director of a large charitable organization; (ii) chief executive officer of a major professional sports business; (iii) a member of the Audit Committee and of the audit committees of other public companies; (iv) a certified public accountant; (v) a director of a large national bank; and (vi) a college assistant professor of accounting.expert."

24 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 27

| John L. Harrington Committee Chair |

"The Compensation Committee regularly evaluates the Company's compensation practices and considers the incentives and risks associated with the Company's compensation practices."

Additional Committee Members: Joseph L. Morea and Jeffrey P. Somers

Meetings Held in 2017:2018: 16

Purpose and Primary Responsibilities:Role:

The purpose of the Compensation Committee is comprised solely of Independent Trustees. Its primary responsibilities pertain to discharge directly, or assist the Board in discharging, its responsibilities related to: (1) the evaluation ofevaluating the performance and compensation of the businessTRA, of our executive officers and property management services provider to the Company, the Chief Executive Officer, the co-Presidents, the Chief Financial Officer and Treasurer and any other executive officer of the Company and theour Director of Internal Audit, of the Company; (2) the compensation of the Trustees;evaluating and (3) the approval, evaluationapproving any changes in our agreements with TRA and administration of anyapproving equity compensation plans of the Company. Under its charter, the Compensation Committee is responsible for the determination and approval of any compensation payable by the Company to the Chief Executive Officer, the co-Presidents, the Chief Financial Officer and Treasurer and any other executive officer of the Company based on such evaluation.awards. The Compensation Committee is also responsible for the evaluation and recommendationrecommends to the Board of the cash compensation payable by the Company to theour Trustees for Board and committee service and the annual evaluation of the performance of the Director of Internal Audit and the determination of his or her compensation. In addition, the Compensation Committee is responsible for the annual review of any business and propertyservice. It also reviews amounts payable by us to TRA under our management agreement of the Company with the business and property management services provider to the Company, the proposal and approval ofapproves any proposed amendments to or termination of any business and property management agreement of the Company with any such provider to the Company and the review of amounts payable by the Company under any such management agreements.

Independence:Each member of the Compensation Committee meets the independence requirements of the Nasdaq, the Exchange Act and the Company's Governance Guidelines.that agreement.

28 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 25

Nominating and Governance Committee

| Jeffrey P. Somers Committee Chair |

"The Nominating and Governance Committee regularly evaluates the Board's leadership structure and corporate governance to promote the best long term interests of the Company."

Additional Committee Members: John L. Harrington and Joseph L. Morea

Meetings Held in 2017:2018: 13

Purpose and Primary Responsibilities:Role:

The principal purposes of the Nominating and Governance Committee are: (1)is comprised solely of Independent Trustees. Its primary role is to identify individuals qualified to become Board members, consistent with criteria approved by the Board, and to recommend candidates to the entire Board for nomination or selection as Board members for each annual meeting of shareholders (or special meeting of shareholders at which Trustees are to be elected) or when vacancies occur; (2)occur, to perform certain assessments of the Board and Company management;Board committees, including to assess the independence of Trustees and (3)Trustee nominees, and to develop and recommend to the Board a set of governance principles applicable tofor the Company. Under its charter, the Nominating and Governance Committee is also responsible for overseeingconsidering and reporting on the evaluation of Company managementCompany's succession planning to the extent not overseen by the Compensation Committee or another committee of the Board.

Independence:Each member of the Nominating and Governance Committee meets the independence requirements of the Nasdaq, the Exchange Act and the Company's Governance Guidelines.

26 TREMONT MORTGAGE TRUST ![]()

20182019 Proxy Statement 29

Board Oversight of Risk |